- Life Insurance Options

- Long-term care insurance

- Permanent Life Insurance

- Top-Rated Companies to Compare

- Term vs. Permanent Life Insurance

- What Affects Your Life Insurance Premiums and Costs?

- Life Insurance Buying Guide

- Benefits of Life Insurance

- Who Needs Life Insurance?

- Considerations Before Buying Life Insurance

- How Life Insurance Works

- Life Insurance Riders and Policy Changes

- Qualifying for Life Insurance

- Who Needs Life Insurance?

- What Affects Your Life Insurance Premiums?

- What Are the Benefits of Life Insurance?

- How Do You Qualify for Life Insurance?

- How Does Life Insurance Work?

A life insurance policy is an agreement between a policy holder and a life insurance company. In return for premiums paid by the policyholder during their lifetime, a life insurance policy promises the insurer will pay an amount of money to one or more named beneficiaries after the covered person passes away.

Life Insurance Options

There are numerous life insurance options to suit a wide range of requirements and tastes. The fundamental decision of whether to choose temporary or permanent life insurance is crucial to take into account, depending on the short- or long-term demands of the individual to be insured.

Long-term care insurance

Term life insurance is intended to last for a set period of time before expiring. When you purchase the insurance, you select the term. The usual durations are 10, 20, or 30 years. The finest term life insurance plans strike a compromise between cost-effectiveness and long-term financial stability.

- Decreasing term life insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate.

- Convertible term life insurance allows policyholders to convert a term policy to permanent insurance.

- Renewable term life insurance provides a quote for the year the policy is purchased. Premiums increase annually and are usually the least expensive term insurance in the beginning.

Once the term is finished, many term life insurance policies allow you to renew the contract each year. This is one approach to extend your life insurance coverage, but because the renewal rate is determined by your age at the time, annual rates may increase dramatically. Converting your term life insurance policy to a permanent policy is a superior option for long-term protection. If this is important to you, search for a convertible term policy because this is not always an option on term life insurance policies.

Permanent Life Insurance

Until the policyholder stops making premium payments or surrenders the policy, permanent life insurance remains in effect for the duration of the insured’s life. It costs more than the term.

- Whole life insurance is a type of permanent life insurance. It accumulates a cash value in order to last the lifetime of the insured person. Cash-value life insurance also allows the policyholder to use the cash value for many purposes, such as a source of loans or cash or to pay policy premiums.

- Universal life (UL) insurance is a type of permanent life insurance with a cash value component that earns interest. Universal life features flexible premiums. Unlike term and whole life, the premiums can be adjusted over time and designed with a level death benefit or an increasing death benefit.

- Indexed universal life (IUL) is a type of universal life insurance that lets the policyholder earn a fixed or equity-indexed rate of return on the cash value component.

- Variable universal life (VUL) insurance allows the policyholder to invest the policy’s cash value in an available separate account. It also has flexible premiums and can be designed with a level death benefit or an increasing death benefit.

Top-Rated Companies to Compare

| Company | AM Best Rating | Coverage Capacity | Maximum Issue Age | Policies Offered |

|---|---|---|---|---|

| Nationwide Best Overall Compare Quotes on BestMoney | A+ | Over $5 million | 85 | Term, whole, UL, IUL, VUL, final expense |

| Protective Best for Term Compare Quotes on BestMoney | A+ | Over $5 million | 85 | Term, whole, UL, IUL, VUL |

| MassMutual Best for Financial Stability Compare Quotes on BestMoney | A++ | Over $5 million | 90 | Term, whole, UL, VUL |

| Mutual of Omaha Best for Living BenefitsCompare Quotes on BestMoney | A+ | Over $5 million | 85 | Term, UL, IUL, final expense |

| Guardian Fewest Complaints Compare Quotes on BestMoney | A++ | Over $5 million | 90 | Term, whole, UL, VUL |

| USAA Best for Military Compare Quotes on BestMoney | A++ | Over $5 million | 85 | Term, whole, UL |

| New York Life Best for SeniorsCompare Quotes on BestMoney | A++ | Over $5 million | 90 | Term, whole, UL, VUL |

Term vs. Permanent Life Insurance

Although term life insurance and permanent life insurance have several key differences, most customers looking for low-cost life insurance coverage find that term life insurance best suits their needs. Term life insurance is limited in duration and provides a death benefit in the event that the policyholder passes away before the term has ended. As long as the policyholder continues to make premium payments, permanent life insurance remains in force. Another significant distinction concerns premiums; because term life does not require the development of a financial value, it is typically significantly less expensive than permanent life.

The amount of money needed to sustain your dependents’ level of living or fulfill the requirement for which you are acquiring a policy should be determined before you apply for life insurance. Furthermore take into account how long you will require coverage.

If you are the primary caregiver and your children are 2 and 4 years old, for instance, you would need adequate insurance to cover your custodial responsibilities until your children are old enough to support themselves.

If you want to add money for education, you can examine the cost of hiring a nanny and a housekeeper or employing commercial child care and cleaning services. In your life insurance estimate, take into account your spouse’s retirement needs as well as any outstanding mortgages. especially if the partner is a stay-at-home parent or earns much less. If you can afford it, sum up these costs over the following 16 or so years, adjust for inflation, and that’s the death benefit you might choose to purchase.

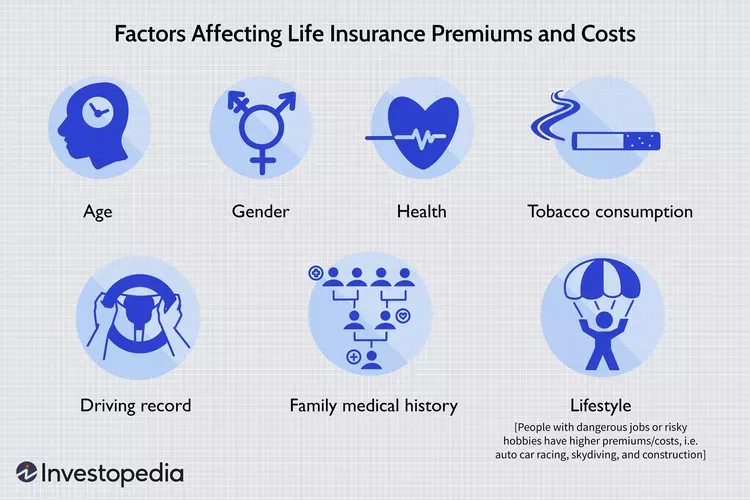

What Affects Your Life Insurance Premiums and Costs?

The price of life insurance premiums might vary depending on a variety of factors. While some circumstances may be beyond your control, you might potentially reduce the cost before (and even after) applying by controlling other requirements. The best plan of action is frequently to purchase life insurance as soon as you need it because your age and health are the two main elements that affect pricing.

If your health has improved and you’ve adopted a healthier lifestyle after receiving insurance policy approval, you can ask to have your risk category changed. Your rates won’t increase even if it turns out that your health is worse than it was at the time of the original underwriting. Your premiums can go down if your health is determined to be improved. Also, you might be able to purchase more coverage for a lesser price than you originally paid.

Life Insurance Buying Guide

Step 1: Determine How Much You Need

Consider what costs would need to be paid in the event of your passing. Mortgage, college costs, and other bills, not to mention burial costs, are just a few examples. If your spouse or other family members depend on you for financial support but are unable to do it on their own, income replacement is a crucial consideration.

Online calculators are available to assist you determine the lump payment that will cover any necessary fees.

Step 2: Prepare Your Application

Applications for life insurance typically ask for beneficiary information as well as personal and family medical history. You might be required to have a medical examination, and you’ll have to be honest about any past health issues, histories of moving offenses and DUIs, and any risky pastimes like skydiving or motor racing. The following components are essential to the majority of life insurance applications:

- Age: This is the most important factor because life expectancy is the biggest determinant of risk for the insurance company.

- Gender: Because women statistically live longer, they generally pay lower rates than males of the same age.

- Smoking: A person who smokes is at risk for many health issues that could shorten life and increase risk-based premiums.

- Health: Medical exams for most policies include screening for health conditions like heart disease, diabetes, and cancer and related medical metrics that can indicate risk.

- Lifestyle: Dangerous lifestyles can make premiums much more expensive.

- Family medical history: If you have evidence of major disease in your immediate family, your risk of developing certain conditions is much higher.

- Driving record: A history of moving violations or drunk driving can dramatically increase the cost of insurance premiums.

Standard forms of identification will also be needed before a policy can be written, such as your Social Security card, driver’s license, or U.S. passport.

Step 3: Compare Policy Quotes

When you’ve assembled all of your necessary information, you can gather multiple life insurance quotes from different providers based on your research. Prices can differ markedly from company to company, so it’s important to take the effort to find the best combination of policy, company rating, and premium cost. Because life insurance is something you will likely pay monthly for decades, it can save an enormous amount of money to find the best policy to fit your needs.

Benefits of Life Insurance

The advantages of getting life insurance are numerous. The most significant benefits and safeguards provided by life insurance policies are listed below.

Most people buy life insurance to give money to beneficiaries who would be financially disadvantaged in the event of the insured’s passing. The tax benefits of life insurance, such as the tax-deferred growth of cash value, tax-free dividends, and tax-free death payments, might, however, present extra strategic opportunities for wealthy people.

Avoiding Taxes

A life insurance policy’s death benefit is typically tax-free. To cover estate taxes, wealthy people occasionally purchase permanent life insurance within trusts. This tactic aids in maintaining the estate’s worth for the benefit of the heirs.

Tax evasion, which is unlawful, should not be confused with tax avoidance, which is a lawful method of reducing one’s tax obligation.

Who Needs Life Insurance?

Life insurance provides financial support to surviving dependents or other beneficiaries after the death of an insured policyholder. Here are some examples of people who may need life insurance:

- Parents with minor children. If a parent dies, the loss of their income or caregiving skills could create a financial hardship. Life insurance can make sure the kids will have the financial resources they need until they can support themselves.

- Parents with special-needs adult children. For children who require lifelong care and will never be self-sufficient, life insurance can make sure their needs will be met after their parents pass away. The death benefit can be used to fund a special needs trust that a fiduciary will manage for the adult child’s benefit.

- Adults who own property together. Married or not, if the death of one adult would mean that the other could no longer afford loan payments, upkeep, and taxes on the property, life insurance may be a good idea. One example would be an engaged couple who take out a joint mortgage to buy their first house.

- Seniors who want to leave money to adult children who provide their care. Many adult children sacrifice time at work to care for an elderly parent who needs help. This help may also include direct financial support. Life insurance can help reimburse the adult child’s costs when the parent passes away.

- Young adults whose parents incurred private student loan debt or cosigned a loan for them. Young adults without dependents rarely need life insurance, but if a parent will be on the hook for a child’s debt after their death, the child may want to carry enough life insurance to pay off that debt.

- Children or young adults who want to lock in low rates. The younger and healthier you are, the lower your insurance premiums. A 20-something adult might buy a policy even without having dependents if there is an expectation to have them in the future.

- Stay-at-home spouses. Stay-at-home spouses should have life insurance as they have significant economic value based on the work they do in the home. According to Salary.com, the economic value of a stay-at-home parent would have been equivalent to an annual salary of $162,581 in 2018.

- Wealthy families who expect to owe estate taxes. Life insurance can provide funds to cover the taxes and keep the full value of the estate intact.

- Families who can’t afford burial and funeral expenses. A small life insurance policy can provide funds to honor a loved one’s passing.

- Businesses with key employees. If the death of a key employee, such as a CEO, would create a severe financial hardship for a firm, that firm may have an insurable interest that will allow it to purchase a life insurance policy on that employee.

- Married pensioners. Instead of choosing between a pension payout that offers a spousal benefit and one that doesn’t, pensioners can choose to accept their full pension and use some of the money to buy life insurance to benefit their spouse. This strategy is called pension maximization.

- Those with preexisting conditions. Such as cancer, diabetes, or smoking. Note, however, that some insurers may deny coverage for such individuals, or else charge very high rates.

Each policy is unique to the insured and insurer. It’s important to review your policy document to understand what risks your policy covers, how much it will pay your beneficiaries, and under what circumstances.

Considerations Before Buying Life Insurance

Research Policy Options and Company Reviews

Given that life insurance policies are a significant investment and financial commitment, it’s crucial to conduct adequate research to ensure the company you select has a strong track record and financial stability. After all, your heirs might not start receiving death benefits for decades. Many insurance providers have been analyzed by Investopedia, which has ranked the best in a variety of categories.

Consider How Much Death Benefit You Need

In order to safeguard your loved ones should you pass away while the policy is still in effect, life insurance can be a wise financial strategy. But there are times when it doesn’t make sense, such when you buy too much or insure people whose income doesn’t need to be replaced. It is crucial to take the following into account.

What bills couldn’t be paid if you passed away? It might not be necessary if your partner makes a good living and you don’t have any children. It is nevertheless crucial to take into account how your impending demise would affect a spouse and how much help they would require financially so they could grieve without having to worry about going back to work before they are ready. Yet, if maintaining a desired lifestyle or meeting financial obligations requires the income of both spouses, then both spouses may require individual life insurance coverage.

Know Why You’re Buying Life Insurance

It’s crucial to consider your insurance goals before purchasing a policy on the life of a family member. Children and seniors really don’t have any meaningful income to replace, but in the event of their deaths, burial costs may need to be paid. A parent may choose to buy a modest-sized insurance when their child is young in order to safeguard their future insurability in addition to paying for burial costs. By doing this, a parent can make sure that their child will be able to support their future family financially. Only up to 25% of the policy that is currently in effect on their own lives can parents buy life insurance for their kids.

Could investing the money that would be paid in premiums for permanent insurance throughout a policy earn a better return over time? As a hedge against uncertainty, consistent saving and investing—for example, self-insuring—might make more sense in some cases if a significant income doesn’t need to be replaced or if policy investment returns on cash value are overly conservative.

How Life Insurance Works

A life insurance policy has two main components—a death benefit and a premium. Term life insurance has these two components, but permanent or whole life insurance policies also have a cash value component.

- Death benefit. The death benefit or face value is the amount of money the insurance company guarantees to the beneficiaries identified in the policy when the insured dies. The insured might be a parent, and the beneficiaries might be their children, for example. The insured will choose the desired death benefit amount based on the beneficiaries’ estimated future needs. The insurance company will determine whether there is an insurable interest and if the proposed insured qualifies for the coverage based on the company’s underwriting requirements related to age, health, and any hazardous activities in which the proposed insured participates.

- Premium. Premiums are the money the policyholder pays for insurance. The insurer must pay the death benefit when the insured dies if the policyholder pays the premiums as required, and premiums are determined in part by how likely it is that the insurer will have to pay the policy’s death benefit based on the insured’s life expectancy. Factors that influence life expectancy include the insured’s age, gender, medical history, occupational hazards, and high-risk hobbies. Part of the premium also goes toward the insurance company’s operating expenses. Premiums are higher on policies with larger death benefits, individuals who are at higher risk, and permanent policies that accumulate cash value.

- Cash Value. The cash value of permanent life insurance serves two purposes. It is a savings account that the policyholder can use during the life of the insured; the cash accumulates on a tax-deferred basis. Some policies may have restrictions on withdrawals depending on how the money is to be used. For example, the policyholder might take out a loan against the policy’s cash value and have to pay interest on the loan principal. The policyholder can also use the cash value to pay premiums or purchase additional insurance. The cash value is a living benefit that remains with the insurance company when the insured dies. Any outstanding loans against the cash value will reduce the policy’s death benefit.

The policy owner and the insured are usually the same person, but sometimes they may be different. For example, a business might buy key person insurance on a crucial employee such as a CEO, or an insured might sell their own policy to a third party for cash in a life settlement.

Life Insurance Riders and Policy Changes

Several insurance providers provide customers the choice to alter their policies to meet their specific needs. The most typical approach for policyholders to alter or adjust their plans is through riders. Although there are numerous riders, availability varies per supplier. Although some plans contain certain riders in their base premium, it is customary for the policyholder to pay an additional premium or a fee to use the rider.

- The accidental death benefit rider provides additional life insurance coverage in the event the insured’s death is accidental.

- The waiver of premium rider relieves the policyholder of making premium payments if the insured becomes disabled and unable to work.

- The disability income rider pays a monthly income in the event the policyholder becomes unable to work for several months or longer due to a serious illness or injury.

- Upon diagnosis of terminal illness, the accelerated death benefit rider allows the insured to collect a portion or all of the death benefit.

- The long-term care rider is a type of accelerated death benefit that can be used to pay for nursing-home, assisted-living, or in-home care when the insured requires help with activities of daily living, such as bathing, eating, and using the toilet.

- A guaranteed insurability rider lets the policyholder buy additional insurance at a later date without a medical review.

Borrowing Money. Most permanent life insurance accumulates cash value that the policyholder can borrow against. Technically, you are borrowing money from the insurance company and using your cash value as collateral. Unlike with other types of loans, the policyholder’s credit score is not a factor. Repayment terms can be flexible, and the loan interest goes back into the policyholder’s cash value account. Policy loans can reduce the policy’s death benefit, however.

Funding Retirement. Policies with a cash value or investment component can provide a source of retirement income. This opportunity can come with high fees and a lower death benefit, so it may only be a good option for individuals who have maxed out other tax-advantaged savings and investment accounts. The pension maximization strategy described earlier is another way life insurance can fund retirement.

It’s prudent to reevaluate your life insurance needs annually or after significant life events, such as divorce, marriage, the birth or adoption of a child, or major purchases, such as a house. You may need to update the policy’s beneficiaries, increase your coverage, or even reduce your coverage.

Qualifying for Life Insurance

With hundreds of insurers to choose from, practically anyone can find an affordable coverage that at least partially satisfies their criteria. Insurers analyze each life insurance applicant individually. According to the Insurance Information Institute, there were 841 life insurance and annuity companies operating in the United States as of 2018.

Also, a lot of life insurance providers offer a variety of amounts and types of coverage, and some of them focus on providing solutions for particular needs, such policies for those who have ongoing medical concerns. Also, there are brokers with a focus on life insurance who are aware of what each company offers. Candidates can work for free with a broker to find the insurance they require. This means that, if they look hard enough, are ready to pay a high enough premium, or accept a death benefit that may be less than ideal, almost everybody may find some form of life insurance coverage.

The insurance market is far larger than many customers know, so even if prior applications have been turned down or estimates have been out of reach, buying life insurance may be attainable and cheap. Insurance is not just for the healthy and rich.

In general, getting approved for life insurance will be easier the younger and healthier you are, and tougher the older and unhealthier you are. However, some lifestyle choices, such as smoking or partaking in risky pastimes like skydiving, make it more difficult to qualify or result in higher premiums.

Who Needs Life Insurance?

You need life insurance if you need to provide security for a spouse, children, or other family members in the event of your death. Life insurance death benefits, depending on the policy amount, can help beneficiaries pay off a mortgage, cover college tuition, or help fund retirement. Permanent life insurance also features a cash value component that builds over time.

What Affects Your Life Insurance Premiums?

- Age (life insurance is less expensive)

- Gender (female tends to be less expensive)

- Smoking (smoking increases premiums)

- Health (poor health can raise premiums)

- Lifestyle (risky activities can increase premiums)

- Family medical history (chronic illness in relatives can raise premiums)

- Driving record (good drivers save on premiums)

What Are the Benefits of Life Insurance?

- Payouts are tax-free. Life insurance death benefits are paid as a lump sum and are not subject to federal income tax because they are not considered income for beneficiaries.

- Dependents don’t have to worry about living expenses. Most policy calculators recommend a multiple of your gross income equal to seven to 10 years that can cover major expenses like mortgages and college tuition without the surviving spouse or children having to take out loans.

- Final expenses can be covered. Funeral expenses can be significant and can be avoided with a burial policy or with standard term or permanent life policies.

- Policies can supplement retirement savings. Permanent life policies such as whole, universal, and variable life insurance can offer cash value in addition to death benefits, which can augment other savings in retirement.

How Do You Qualify for Life Insurance?

You need to fill out an application in order to be eligible for life insurance. But practically everyone can purchase life insurance. But, depending on your age, health, and way of life, the price or premium amount can change significantly. There are certain life insurance policies that don’t ask for medical information, but they often have substantially higher premiums and a waiting time before the death benefit becomes payable.

How Does Life Insurance Work?

In order to provide a death benefit in exchange for paying premiums, life insurance functions. One common kind of life insurance, called term life insurance, only lasts for a predetermined period, such 10 or 20 years. Although the death benefit of permanent life insurance likewise lasts during the policyholder’s lifetime as long as premiums are paid, it does not.